1098-T Information Tax Year 2017 or earlier

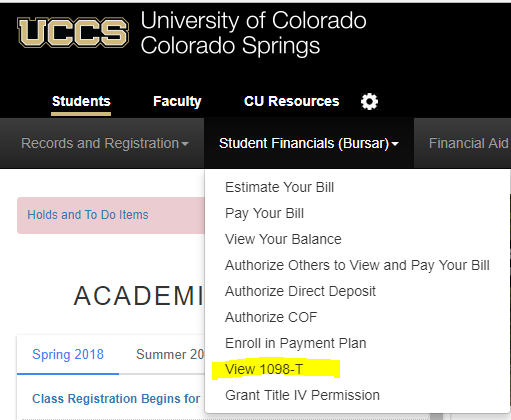

Available in the Student Portal

1098-T forms for the previous calendar year will be available in the myUCCS student portal no-later-than January 31.

The forms will be available only if you meet ALL of the following criteria:

- You have a valid, active home or mailing address on file at UCCS.

- You have tax-reportable tuition, fees, or financial aid transactions on your account for that calendar year, including prior-year adjustments.

Items Reported on the 1098-T

The items below are generally reported on the 1098-T. See the next section for exceptions.

- Tuition

- Mandatory Student Fees

- Course/lab Fees

- Waivers

- Scholarships

- Grants

Items NOT Reported on the 1098-T

The items below are NOT reported on the 1098-T. Unless noted otherwise, the IRS does not generally allow you to claim these items when calculating your allowable educational expenses and payments.

- College Opportunity Fund (COF) - Although not reported as a reduction of your tuition, you MUST consider this credit when determining your out-of-pocket educational payments.

- Student Loans - If applicable, your loan provider will issue tax statements for deductible loan interest.

- Room and Board Expenses

- Fines (ie., parking, library, late fees)

- Tuition and Fees for Non-Credit Courses

- Books - Although book charges and payments are usually tax deductible, at this time, UCCS does not post those items on student accounts. Keep invoices and receipts of those transactions in your own tax records.

Items Reported as Prior Year Adjustments

Whenever items are adjusted or revised that were reported on 1098-T forms from prior years, those items will be reported differently on the 1098-T.

- Items that are reversed will appear in the applicable prior-year boxes on the 1098-T (boxes 4 or 6).

- Items that are re-assessed will appear in the applicable reporting-year boxes on the 1098-T (boxes 2 or 5).

- Items that are revised (reversed and re-assessed) will appear in the applicable prior-year AND reporting-year boxes respectively on the 1098-T. For tuition and fees, that's boxes 2 and 4, and for scholarships and grants, that's boxes 5 and 6.

Other Resources

UCCS does not provide tax advice for those using the 1098-T to do their taxes. Please consult a tax expert for such advice. Listed below are some resources that may help you.