1098-T Tax Information

Disclaimer

The University of Colorado Colorado Springs is not qualified to provide legal and/or tax advice. The information provided may or may not reflect recent revisions in IRS regulations. For tax advice on your specific situation, contact a tax professional. For additional information regarding the education tax credits, please refer to the Other Resources section below.

Please send 1098-T inquiries to 1098T@uccs.edu

Student Portal Access Recovery

Students who are no longer attending UCCS, who have 1098-T forms, have limited access to the myUCCS student portal for three years after their most recent 1098-T form. Listed below is the UCCS Office of Information Technology (OIT) webpage describing what is needed to regain portal access.

Based on your situation, here are some helpful hints pertaining to the OIT webpage.

- If you have not been an active student for a few semesters, you may need to select the Claim Your Account option.

- If you were recently an active student but have forgotten your password, you may need to select the Recover Your Account option.

- If you were recently an active student and still remember your last password, you may use the Update Password option.

- If you have any issues that cannot be resolved using the OIT webpage, you may contact the OIT Help Desk.

Available in the Student Portal

1098-T forms for the previous calendar year will be available in the myUCCS student portal no-later-than January 31. Students can print the form and provide it to parents or others who may be eligible to claim them as a dependent, if applicable. We cannot provide 1098-T information directly to anyone other than the student (see FERPA). Forms will not be mailed.

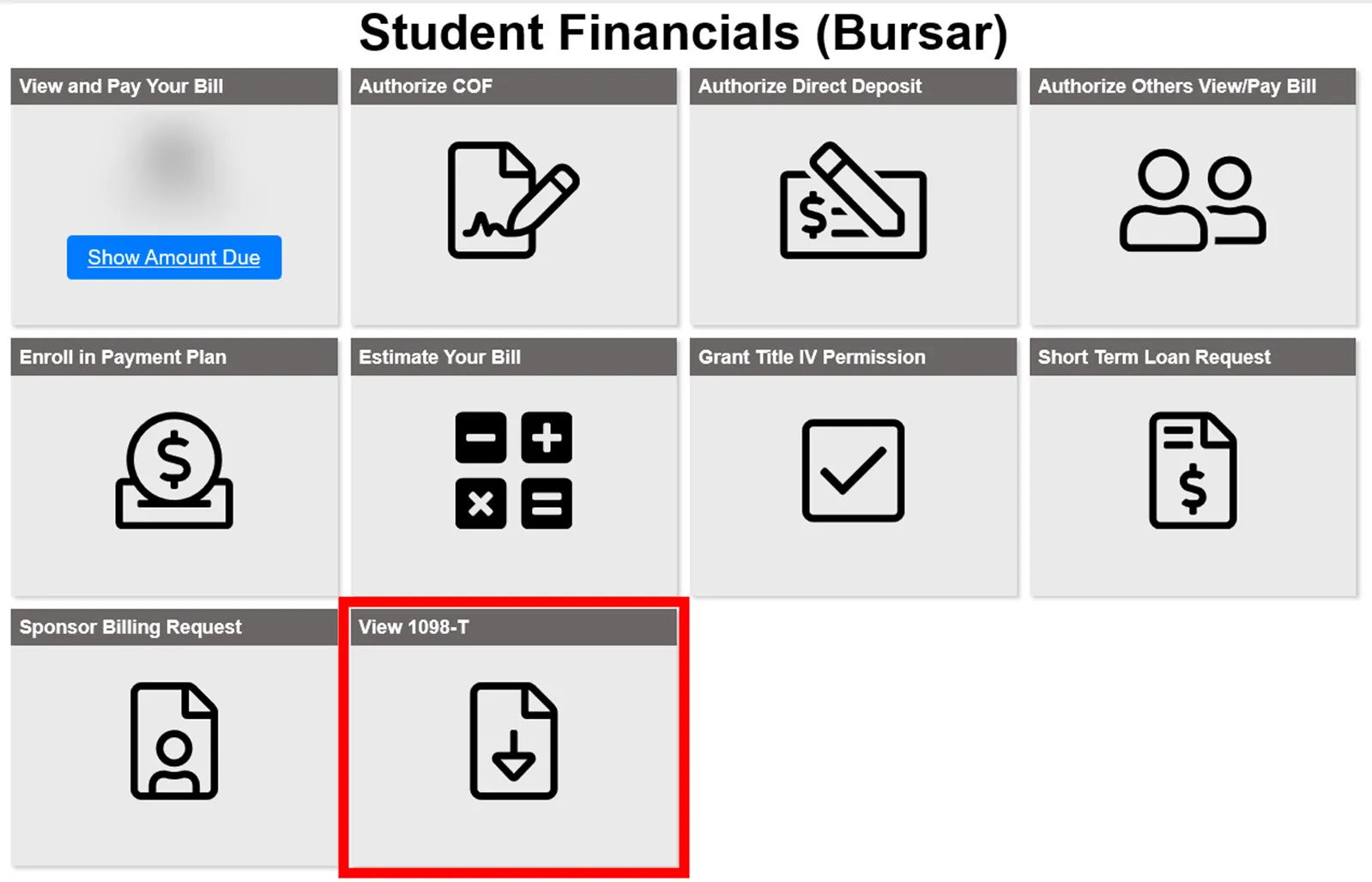

Click below for a guide how to view and download your 1098-T online:

Click here for instructions on how to access, download, and print 1098-T form in the myUCCS student portal.

How to view you 1098-T

New Reporting Method for Tax Year 2018

Starting with tax year 2018, UCCS will change how tuition and fees are reported on the 1098-T Tuition Statement. Information on this page pertains to the new reporting method for 2018 tax year and beyond. Visit the Information Tax Year 2017 or earlier page for information pertaining to the former reporting method.

Items Reported on the 1098-T

The items below are generally reported on the 1098-T. See the next section for exceptions.

- Paid Tuition

- Paid Mandatory Student Fees

- Paid Course/lab Fees

- Waivers

- Scholarships

- Grants

Items NOT Reported on the 1098-T

Payments to or credits from the items below are NOT reported on the 1098-T. Unless noted otherwise, the IRS does not generally allow you to claim these items when calculating your allowable educational expenses and payments.

- College Opportunity Fund (COF) - The COF credit is not reported as a payment towards your tuition in Box 1, nor is it reported as a Grant or Scholarship in Box 5.

- Student Loans - If applicable, your loan provider will issue tax statements for deductible loan interest.

- Room and Board Expenses

- Fines (ie., parking, library, late fees)

- Tuition and Fees for Non-Credit Courses

- Books - per IRS guidelines, book charges and payments are usually tax deductible. For book charges and payments not posted on the student account, those items will not be reported on the 1098-T form. Keep invoices and receipts of those transactions in your own tax records.

Items Reported as Prior Year Adjustments

Whenever items are adjusted or revised that were reported on 1098-T forms from prior years, those items will be reported differently on the 1098-T. Because UCCS changed our 1098-T reporting method from billed items (Box 2) to paid items (Box 1), the 2018 1098-T tax forms will not contain amounts in the prior-year adjustment boxes, except for very rare situations.

- Items that are reversed will appear in the applicable prior-year boxes on the 1098-T (boxes 4 or 6).

- Items that are re-assessed will appear in the applicable reporting-year boxes on the 1098-T (boxes 1 or 5).

- Items that are revised (reversed and re-assessed) will appear in the applicable prior-year AND reporting-year boxes respectively on the 1098-T. For tuition and fees, that's boxes 1 and 4, and for scholarships and grants, that's boxes 5 and 6.

Other Resources

UCCS does not provide tax advice for those using the 1098-T to do their taxes. Please consult a tax expert for such advice. Listed below are some resources that may help you.